U.S. private equity firm TPG is in advanced talks to buy Malaysian private education assets owned by regional buyout firm KV Asia Capital in a deal that could be worth more than $300 million, three sources with knowledge of the matter told Reuters.

An agreement could be struck as early as the first quarter, one of the sources said.

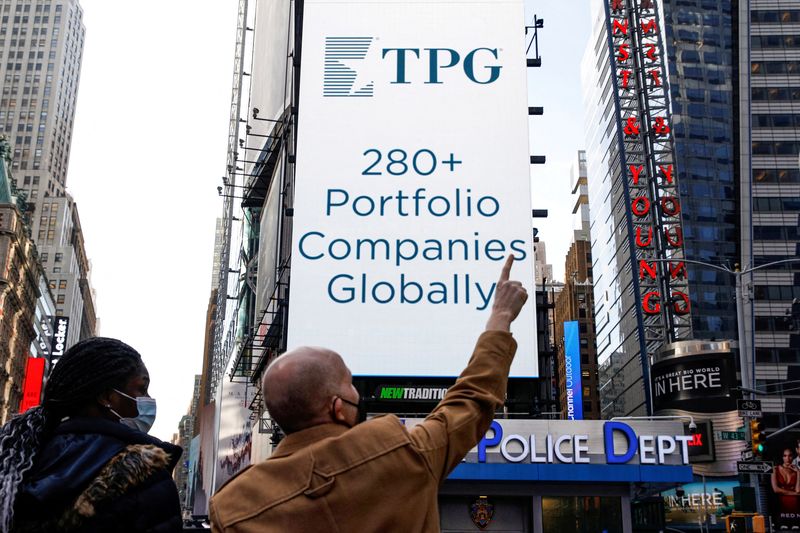

TPG, which has $135 billion of assets under management globally, has been expanding in Southeast Asia in recent years, including in Malaysia.

KV Asia last year appointed Rothschild & Co to explore a sale of Asia Pacific Education Holdings, the sources said, declining to be named because the talks are currently underway.

The growing number of affluent families in Southeast Asia has made education assets in the region attractive to investors.

The sale of Advent International's stake in Singaporean tuition chain The Learning Lab has garnered interest from private equity firms including PAG and Platinum Equity, Reuters reported in November.

Asia Pacific University of Technology & Innovation and Asia Pacific Institute of Information Technology operate out of two campuses and have more than 10,000 students, according to KV Asia's website.

Asia Pacific Education was bought by KV Asia and the education firm's management team in 2018 from Malaysian government-linked private equity fund management company Ekuiti Nasional Bhd, according to an earlier press release.

That deal was based on an enterprise value of 725 million ringgit, but it included primary and secondary school operator Asia Pacific Schools, which was sold a year later for an undisclosed price.

KV Asia focuses on investing in mid-sized Southeast Asian companies in sectors including consumer and healthcare, according to its website.

Its current portfolio includes Indonesian beauty and personal care company PT Victoria Care Indonesia and Singapore-headquartered marine diesel engine services firm Power Diesel, the website shows.