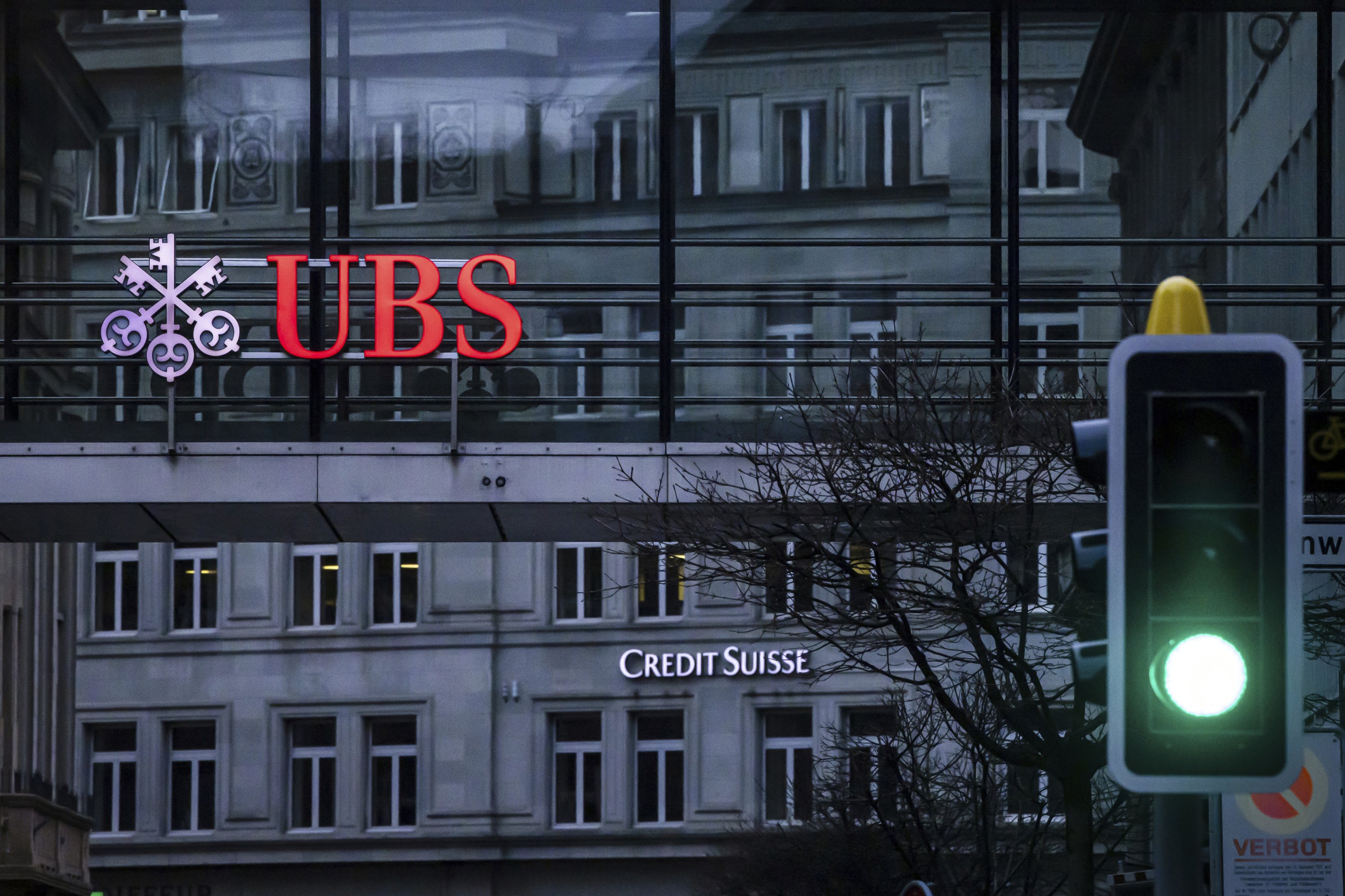

UBS has completed its acquisition of troubled Swiss rival Credit Suisse, creating one of the world's largest banks with $1.6 trillion in assets. The deal marks the largest European banking merger since the 2008 financial crisis.

UBS CEO Sergio Ermotti and Chairman Colm Kelleher said the combination creates challenges but also "many opportunities" for stakeholders. The merged bank will have a leading position in key wealth management markets that would have taken years for UBS to build organically.

The deal effectively ends Credit Suisse's 167-year history marked in recent years by scandals and losses. Credit Suisse shares rose 0.4% on Monday, their final day of trading, while UBS shares also increased by around 0.4%.

Together, the banks employ 120,000 people worldwide, though UBS has said it will cut jobs to reduce costs and realize synergies.

UBS announced changes to its leadership structure, with Credit Suisse to initially operate as a subsidiary. More than one-fifth of UBS's 160 newly confirmed or appointed leaders are coming from Credit Suisse.

Andre Helfenstein will remain head of Credit Suisse's domestic business in Switzerland. UBS said it is considering strategic options for the unit.