Indian shares changed course on Thursday, with investors on edge ahead of earnings reports from IT companies after TCS' warning earlier in the week and key domestic and U.S. inflation data for cues on the likely path for rate hikes.

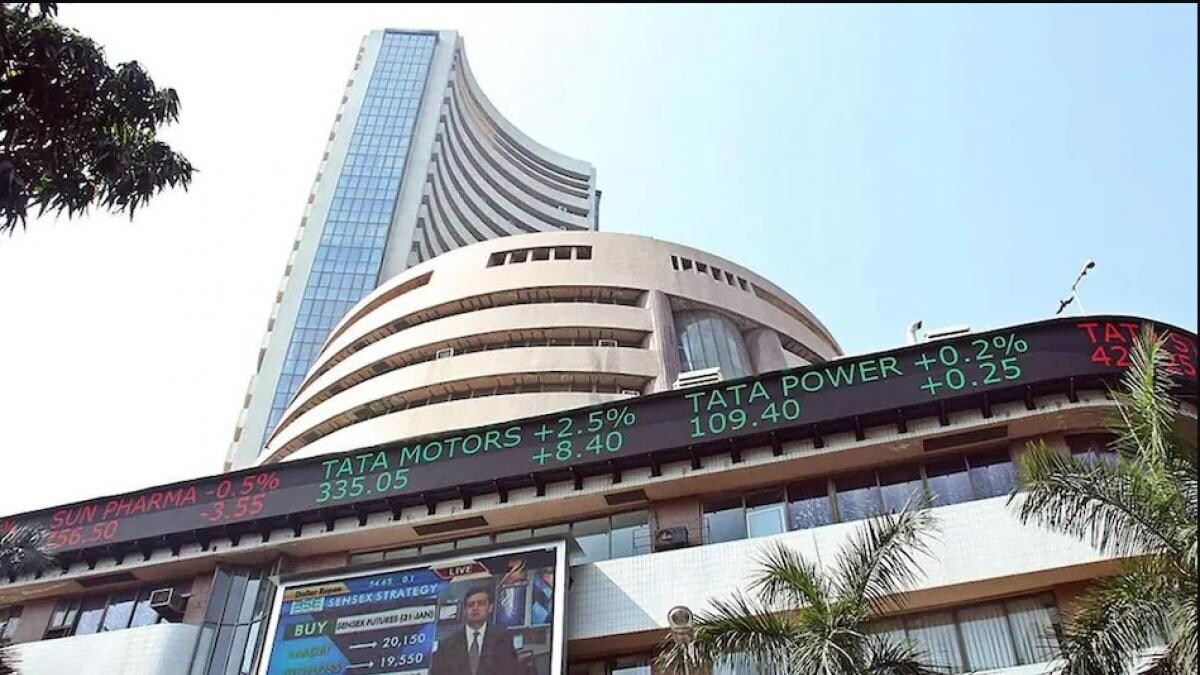

The Nifty 50 index (.NSEI) was down 0.5% at 17,805.90 as of 11:25 a.m. IST, while the S&P BSE Sensex (.BSESN) declined 0.54% to 59,782.29.

"While the expectations suggest cooling off of inflation, a lot depends on the commentary on the data as well as the components of price changes," said Narendra Solanki, head of fundamental research for investment services at Anand Rathi Shares and Stock Brokers.

Volatility will remain ahead of key IT earnings, while the sustained foreign selling weighs, keeping a lid on the positive momentum, Solanki said.

Investors are wary after top software exporter Tata Consultancy Services (TCS.NS)earlier this week missed profit estimates and flagged challenges with deal decisions in Europe.

Meanwhile, foreign institutional investors extended their selling streak for the fourteenth day in a row on Wednesday, offloading 32.08 billion rupees ($393.00 million) worth of equities on a net basis.

India's retail inflation likely held steady last month, staying within the Reserve Bank of India's (RBI) comfort range of 2%-6% for a second month, a Reuters poll of economists found. The data is due later in the day at 5:30 p.m. IST.

U.S. consumer prices index (CPI) is also expected to have moderated in December. The report is due at 7:00 p.m. IST.

However, remarks from Federal Reserve officials earlier this week have pointed to the central bank's need to remain aggressive on rate hikes. Last month, RBI Governor Shaktikanta Das had said the Indian central bank would continue its fight against inflation despite the worst being "behind us".

In domestic trading, IT firm Infosys Ltd (INFY.NS) shed early gains to trade 0.4% lower, while HCL Technologies Ltd (HCLT.NS) was up 1.4% ahead of their quarterly earnings results. IT stocks (.NIFTYIT) overall was up 0.17%.