DUBLIN, July 25, 2022 (Globe Newswire) — Added to the report “Albumin Market by Type and Application: Global Opportunity Analysis and Industry Forecast, 2021–2030” ResearchAndMarkets.com’s Presentation.

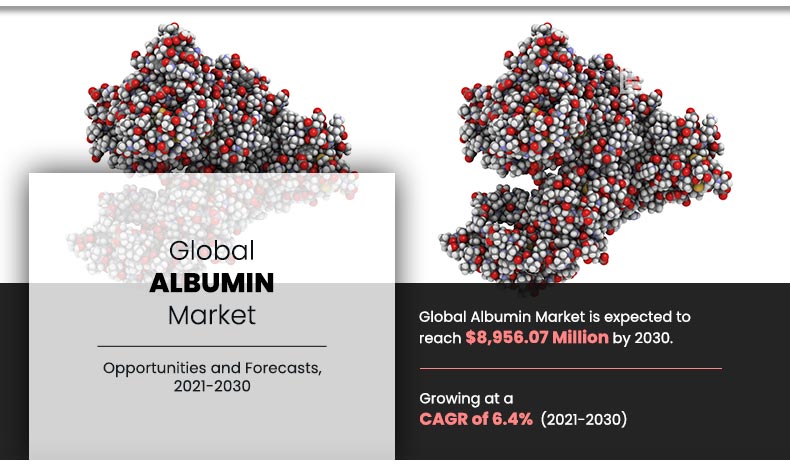

The albumin market was valued at $4,813.5 million in 2020, and is projected to reach $8,956.07 million by 2030, growing at a CAGR of 6.4% from 2021 to 2030. ALSO READ: Illegal Brazilian gold tied to Italian refiners and Big Tech customers – Documents Adhesive Tape Market | Growing demand for paper-backed adhesives drive growth Serum albumin is the most abundant plasma protein, accounting for approximately 50% of human plasma proteins. Albumin is obtained from the plasma fractionation process where human serum albumin and bovine serum albumin are widely used. Recombinant albumin is produced using recombinant techniques in rice plants, yeast species and other cell lines. Albumin is used as a blood volumizer and is used in the treatment of various diseases, including surgical blood loss, shock, burns, trauma, chronic liver disease, hypovolemia, hemorrhage, acute liver failure, hypoalbuminemia, and acute respiratory Includes distress syndrome.

An increase in the prevalence of rare diseases, shock, trauma, burns and other deaths is the major factor contributing to the growth of the albumin market. Furthermore, other factors driving the market growth include increased adoption of albumin products, increased awareness of recombinant albumin products, and increased non-therapeutic application of albumin as an adjuvant and pharmaceutical forming agent. is included.

In addition, many companies are expanding their market presence, thereby expanding their business into new markets. For example, in June 2020, Biotest achieved a major milestone in its international expansion strategy by recording the first company’s sale in China to human albumin, which can be used to treat diseases such as chronic diseases of the kidney and liver and burns. for stabilization. These above factors have fueled the growth of albumin market.

Moreover, due to the high demand for albumin in R&D activities and increasing production of immunoglobulins, the growth in non-therapeutic applications of albumin has fueled the growth of the market. According to the National Clinical Trials Registry, there are approximately 294 ongoing clinical trials involving albumin in various stages of development for various indications. In addition, in March 2020, Curium has received FDA approval for the Pulmotec MAA Kit for the Preparation of Technetium Tc 99m Albumin Aggregated Injection. It is a single photon emitting agent for lung imaging as an adjunct in the evaluation of pulmonary perfusion. Thus, progress in albumin product development is expected to drive the growth of the market.

Conversely, development of cost-effective therapeutics through mass production and high market potential in untapped emerging economies is expected to provide lucrative growth opportunities for the market, hindering market growth. People, nowadays are more health conscious which, in turn, compels them to maintain their health status and increase the demand of albumin for drug development. This has encouraged several major players to enter emerging markets, thus providing a lucrative growth opportunity in the albumin market.

The global albumin market has been segmented on the basis of type, use, content and, end user, and region. By type, the market has been segmented into human serum albumin, bovine serum albumin, and recombinant albumin.

On the basis of application, it is divided into therapeutic, pharmaceutical manufacturing and vaccines, components of media and other applications. Region wise, it is analyzed in North America, Europe, Asia-Pacific and LAMEA.

Some of the major companies operating in the global albumin market are Baxter International Inc., China Biologic Products, Inc., CSL Ltd., Grifols, SA, Merck KGA, Novozymes, Octapharma AG, Takeda Pharmaceuticals Inc., Thermo Fisher Scientific and Ventria Bioscience. ,

Key benefits for stakeholders

story continues

This report provides a comprehensive analysis of current and emerging market trends and dynamics in the global Albumin market in order to identify the prevailing opportunities.

This study presents the competitive landscape of the global market to predict the competitive environment across geographies

A comprehensive analysis of the factors driving and restricting the growth of the market is provided

Sector- and country-wise analysis is provided to understand market trends and dynamics

Major topics covered:

Chapter 1 Introduction

Chapter 2: Executive Summary

Chapter 3: Market Overview 3.1. Definition and Scope of Market 3.2. key findings 3.2.1. top investment pockets 3.3. Market Share Analysis, 2016 3.4. market dynamics 3.4.1. drivers 3.4.1.1. increased prevalence of rare diseases and various life-threatening conditions 3.4.1.2. Increased demand for albumin 3.4.1.3. Growing preferences for recombinant albumin 3.4.1.4. Increasing non-therapeutic application of albumin 3.4.2. Helplessness 3.4.2.1. strict government regulations 3.4.2.2. Albumin-associated risks 3.4.3. opportunity 3.4.3.1. opportunities in emerging economies 3.4.3.2. Development of cost-effective therapeutics through mass production 3.4.4. impact analysis 3.5. Government regulation 3.6. Patent Analysis (2013-2018) 3.6.1. Patent analysis, by year 3.6.2. Patent Analysis for the Year 2017 by Country

Chapter 4: Albumin Market by Product 4.1. Observation 4.1.1. Market size and forecast 4.2. human serum albumin 4.2.1. Key Market Trends, Growth Factors and Opportunities 4.2.2 Market Size and Forecast, Sector Wise 4.2.3. Market Analysis, By Country 4.3. bovine serum albumin 4.3.1. Key Market Trends, Growth Factors and Opportunities 4.3.2. Market size and forecast, by region 4.3.3. Market Analysis, By Country 4.4. recombinant albumin 4.4.1. Key Market Trends, Growth Factors and Opportunities 4.4.2. Market size and forecast, by region 4.4.3. Market Analysis, By Country

Chapter 5: Albumin Market, by Application 5.1. Observation 5.1.1. Market size and forecast (price) 5.2. medical law 5.2.1. Market size and forecast, by region 5.2.2. Market Analysis, By Country 5.3. Pharmaceutical manufacturing and vaccines 5.3.1. Market size and forecast, by region 5.3.2. Market Analysis, By Country 5.4. media component 5.4.1. Market size and forecast, by region 5.4.2. Market Analysis, By Country 5.5. other applications 5.5.1. Market size and forecast, by region 5.5.2. Market Analysis, By Country

Chapter 6: Albumin Market, By Region

Chapter 7: Company Profile 7.1 Baxter International Inc. 7.1.1. Company Overview 7.1.2. company snapshot 7.1.3. operating business segment 7.1.4. product portfolio 7.1.5. trade performance 7.2. China Organic Products Holdings, Inc. 7.2.1. Company Overview 7.2.2. company snapshot 7.2.3. operating business segment 7.2.4. product portfolio 7.2.5. trade performance 7.3. CSL Limited 7.3.1. Company Overview 7.3.2. company snapshot 7.3.3. operating business segment 7.3.4. product portfolio 7.3.5. trade performance 7.4. Grifols SA (Griffoles International, SA) 7.4.1. Company Overview 7.4.2. company snapshot 7.4.3. operating business segment 7.4.4. product portfolio 7.4.5. trade performance 7.4.6. Key strategic moves and developments 7.5. Merck Kaga 7.5.1. Company Overview 7.5.2. company snapshot 7.5.3. operating business segment 7.5.4. product portfolio 7.5.5. trade performance 7.6. Novozyme A/S (Albumedics Ltd.) 7.6.1. Company Overview 7.6.2. operating business segment 7.6.3. product portfolio 7.6.4. trade performance 7.7. Octapharma AG 7.7.1. Company Overview 7.7.2. company snapshot 7.7.3. operating business segment 7.7.4. product portfolio 7.7.5. trade performance 7.8. Takeda Pharmaceuticals 7.8.1. Company Overview 7.8.2. company snapshot 7.8.3. operating business segment 7.8.4. product portfolio 7.8.5. trade performance 7.9. Thermo Fisher Scientific Inc. (Affymetrix, Inc.) 7.9.1. Company Overview 7.9.2. company snapshot 7.9.3. operating business segment 7.9.4. product portfolio 7.9.5. trade performance 7.10. Ventria Bioscience 7.10.1. Company Overview 7.10.2. company snapshot 7.10.3. Operating Product Categories 7.10.4. product portfolio